Inventory Owners vs Catalog Resellers in Indian Dropshipping (2026 Guide)

- Nitya

- Jan 12

- 4 min read

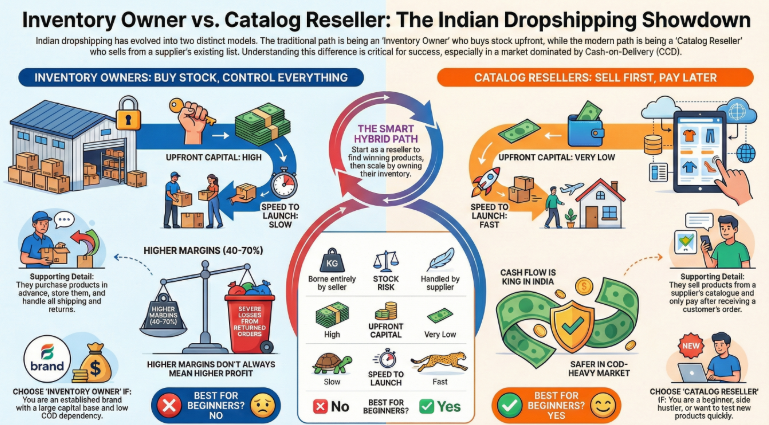

Indian dropshipping has matured fast. What started as a simple “list-and-sell” model has now split into two very different paths: —often shaped by whether sellers work with suppliers offering ready-to-ship fashion catalogs in India or choose to invest in owning inventory.

Inventory Owners

Catalog Resellers

Most beginners don’t clearly understand this difference—and that confusion leads to losses, blocked cash, or stalled growth.

What Is Indian Dropshipping (Quick Context)

If you’re completely new to the concept, this section gives a quick overview. For a detailed walkthrough, refer to Dropshipping In India: A Step By Step Guide For Beginners, which explains the process from setup to first order in depth.

Dropshipping means:

You sell products online

You don’t manufacture them

Orders are shipped by a supplier

But how you access products changes everything.

Who Are Inventory Owners?

Inventory Owners are sellers who:

Buy stock in advance

Store products (own warehouse or 3PL)

Ship orders themselves or via partners

How the Inventory Owner Model Works

Step | What Happens |

Product selection | Seller chooses and buys stock |

Storage | Goods stored in warehouse |

Listing | Seller creates listings |

Order | Seller fulfills from inventory |

Returns | Seller bears full return risk |

Key Characteristics

Aspect | Inventory Owners |

Capital needed | High |

Control | Very high |

Risk | High |

Margins | Higher (if successful) |

Scalability | Slower but stable |

Who Are Catalog Resellers?

Catalog Resellers:

Don’t buy inventory upfront

Sell from a supplier’s ready catalog

Pay only after order is placed

How the Catalog Reseller Model Works

Step | What Happens |

Catalog access | Seller selects ready products |

Listing | Products listed online |

Order | Supplier ships directly |

Payment | Seller pays supplier after order |

Returns | Usually shared or handled by supplier |

Key Characteristics

Aspect | Catalog Resellers |

Capital needed | Low |

Control | Medium |

Risk | Lower |

Margins | Moderate |

Scalability | Faster |

Core Difference: Inventory Owners vs Catalog Resellers

Side-by-Side Comparison Table

Factor | Inventory Owners | Catalog Resellers |

Upfront investment | High | Very low |

Stock risk | Seller | Supplier |

COD RTO impact | Severe | Lower |

Cash flow | Locked | Flexible |

Speed to launch | Slow | Fast |

Suitable for beginners | ❌ | ✅ |

Capital & Cash Flow Reality (India-Specific)

Inventory Owner Cash Flow

Expense | Impact |

Inventory purchase | Cash blocked |

Storage | Monthly cost |

Unsold stock | Dead money |

COD returns | Double loss |

Catalog Reseller Cash Flow

Expense | Impact |

Inventory | Zero upfront |

Storage | None |

COD RTO | Lower exposure |

Scaling | Easier |

In India, where COD dominates, cash flow safety matters more than margin size.

Margins: The Most Misunderstood Part

Reality Check on Margins

Model | Typical Margin | Hidden Reality |

Inventory Owner | 40–70% | High losses from RTO |

Catalog Reseller | 15–35% | Stable & predictable |

Higher margin doesn’t always mean higher profit.

COD & RTO Risk Comparison

RTO Impact Table

Scenario | Inventory Owner | Catalog Reseller |

Fake COD order | Full loss | Partial or none |

Customer rejects | Return cost + stock damage | Often absorbed |

Address issues | Seller problem | Supplier handles |

This is why many Indian sellers start as catalog resellers first.

Scalability & Speed of Growth

Scaling Comparison

Area | Inventory Owner | Catalog Reseller |

New product launch | Slow | Instant |

Festival scaling | Risky | Flexible |

Multi-platform selling | Complex | Easier |

Team size | Larger | Lean |

Some modern Indian dropshipping ecosystems like snazzyway, quietly enable sellers to scale through ready catalogs, tech dashboards, and fulfillment support, —an approach increasingly highlighted in lists of Best Dropshipping Platforms in India for 2026—reducing operational friction without owning inventory.

Operational Complexity

Operations Load Table

Task | Inventory Owner | Catalog Reseller |

Inventory tracking | Manual & complex | Minimal |

Courier coordination | Seller handles | Supplier manages |

Quality checks | Seller | Supplier |

Returns handling | Seller | Shared |

Less complexity = more focus on marketing and growth.

Who Should Choose Inventory Ownership?

Best Fit For

Established brands

Large capital base

Private-label sellers

Low COD dependency

Experienced operators

Not Ideal If

You’re new to ecommerce

You rely heavily on COD

You want fast testing

Who Should Choose Catalog Reselling?

Best Fit For

Beginners

Side hustlers

Marketing-focused sellers

Cash-flow–conscious founders

Testing new niches

Not Ideal If

You want full brand control from day one

Hybrid Model (The Smart Middle Path)

Many successful Indian sellers follow this path:

Stage | Model |

Start | Catalog reselling |

Validate | Find winning products |

Scale | Move winners to inventory |

Brand | Private label selectively |

This reduces risk while building long-term value.

Legal, GST & Compliance Differences

Area | Inventory Owner | Catalog Reseller |

GST filing | Complex | Simpler |

Invoicing | Seller-generated | Often automated |

Compliance load | High | Lower |

Common Mistakes Sellers Make

Mistake | Why It Fails |

Buying inventory too early | Cash stuck |

Ignoring COD behavior | Heavy losses |

Chasing high margins | Poor survival |

No supplier evaluation | Quality issues |

Future Outlook (2026–2030)

Trend | Impact |

AI-driven catalogs | Faster scaling |

RTO intelligence | Lower losses |

Lean seller teams | More competition |

Brand transition | Hybrid models win |

Frequently Asked Questions (FAQ)

Is inventory ownership better than catalog reselling?

No. It depends on capital, risk appetite, and experience.

Can beginners start as inventory owners?

Yes, but it’s risky in India due to COD and RTO.

Is catalog reselling sustainable long term?

Yes, especially when combined with brand building later.

Do catalog resellers earn less profit?

Margins are lower, but net profit can be more stable.

Can I switch models later?

Yes. Many sellers start with catalogs and move to inventory.

Does AI help both models?

Yes. AI improves product selection, pricing, ads, and logistics in both.

Comments